高齢化している割には日本の国民負担率(GDP比)は低いです

— Spica (@CasseCool) October 16, 2024

US 27.1%

日本 34.4%

UK 36.2%

スウェーデン 37.1%

ドイツ 42.0%

フランス 47.2%https://t.co/ATg8ikg5sl

日本の問題は負担率の高さではなく、負担が現役世代に偏っていること。引退世代も公平に負担する消費税率が低すぎる https://t.co/bTxjeuDvvE

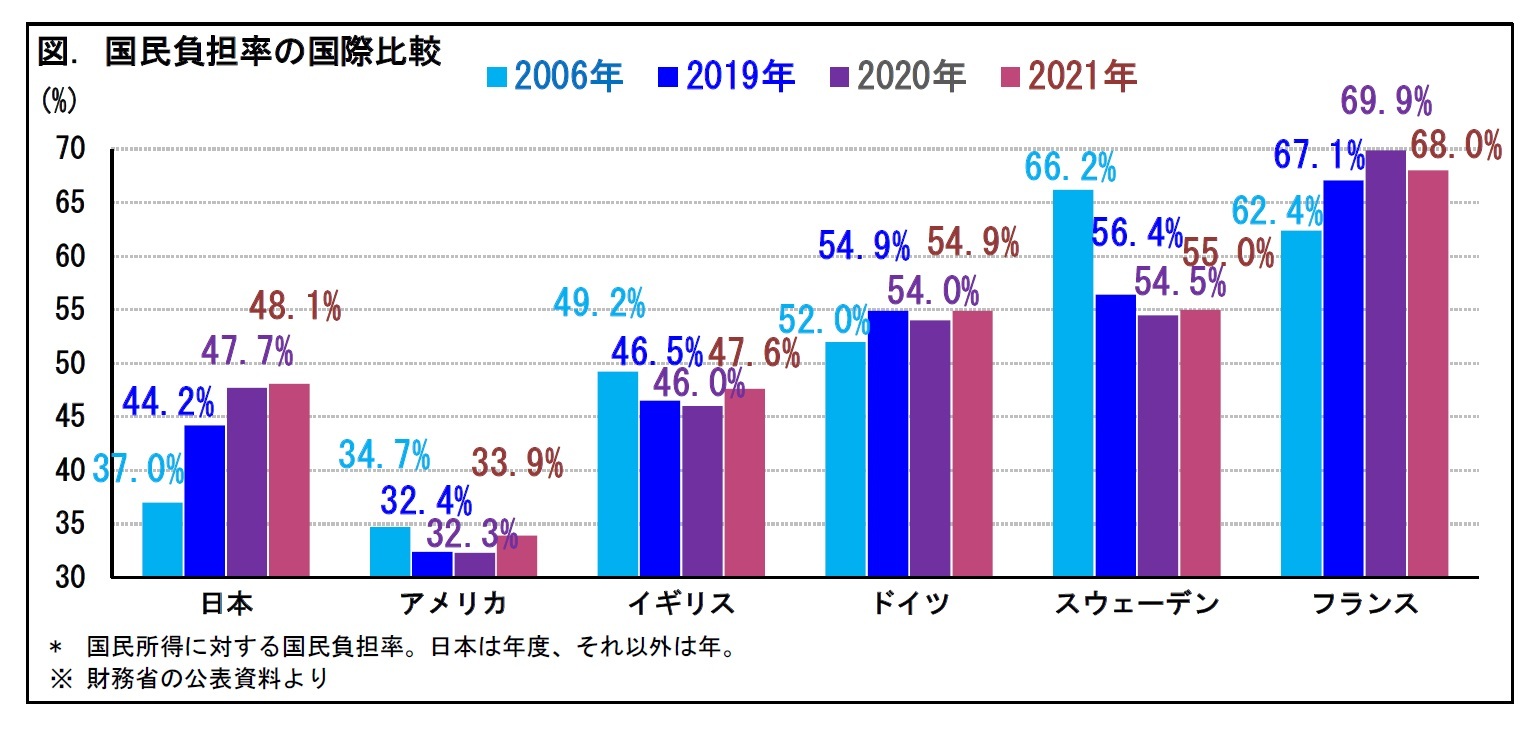

比較可能な直近のデータとして、2021年(日本は2021年度)の数字をみてみる。日本48.1%(対前年度 +0.4ポイント)、アメリカ33.9%(対前年 +1.6ポイント)、イギリス47.6%(同 +1.6ポイント)、ドイツ54.9%(同 +0.9ポイント)、スウェーデン55.0%(同 +0.5ポイント)、フランス68.0%(同 -1.9ポイント)となっている。

すごいね。

潜在的国民負担率について、2021年(日本は2021年度)の数字を比較してみよう。日本57.3%、アメリカ48.5%、イギリス58.0%、ドイツ59.8%、スウェーデン55.0%、フランス77.4%となっている。この6ヵ国の比較では、日本は、イギリスやドイツに迫る水準となっている。

潜在的国民負担率とは?

*Copilot潜在的国民負担率は、国民が直接的に支払う税金(所得税、住民税など)や社会保険料(健康保険、年金など)だけでなく、政府の財政赤字を将来的に埋め合わせるために必要な負担額を含めたものです。具体的には以下のような負担が考慮されます:

直接税: 所得税、法人税など。 間接税: 消費税、酒税など。

社会保険料: 健康保険料、年金保険料など。

将来の財政負担: 現在の財政赤字や政府債務を将来的に埋め合わせるための負担。

この指標を用いることで、国民が将来的にどれだけの負担を負う可能性があるかを把握することができます。

へええ。

例えば、イギリスでも世代間格差あるんちゃうの?

Chat GPT

Yes, there are generational gaps in the national burden ratio in the UK, and these gaps often reflect differences in how much various age groups contribute to or rely on government resources like pensions, healthcare, and welfare. The national burden ratio essentially measures the extent to which working-age people support those who are dependent (children, retirees, or others).

Some key reasons for generational gaps in the UK include:

1. **Aging Population**: As the UK population ages, the number of retirees dependent on pensions and healthcare services increases. This puts a greater financial strain on the working-age population, as they are required to contribute more to support these services.

2. **Pension Contributions and Benefits**: Younger generations are contributing to pension systems that are more strained than in the past, largely due to the longer lifespans and higher number of retirees. Additionally, older generations are often benefiting from more generous pension arrangements, whereas younger workers might expect less in the future.

3. **Public Services**: The cost of public services, including healthcare, is rising, especially with a larger elderly population that requires more medical attention. The younger working population shoulders much of the tax burden to maintain these services.

4. **Wage Stagnation**: Younger generations in the workforce may face wage stagnation, making it harder to support dependents or to save for their own futures, compared to previous generations who may have benefited from better wage growth.

5. **House Prices and Living Costs**: Older generations often benefited from lower housing prices, whereas younger people face higher living costs. This exacerbates generational inequalities in terms of wealth and savings.

This combination of demographic changes, economic pressures, and policy shifts means that generational gaps in the national burden ratio are becoming more pronounced in the UK.

あるんだな。

世代間格差と所得格差とどっちがひどいんだろう?

自分

Which gap is wider, generation gaps in the national burden ratio and income gap?

Chat GPT

When comparing **generation gaps in the national burden ratio** and the **income gap**, both represent significant challenges, but they function in different ways and affect different aspects of society. Here’s an overview of both concepts and how wide each gap can be:

### **Generation Gaps in the National Burden Ratio**

- **National Burden Ratio** refers to the proportion of a nation's income (like GDP) that goes toward taxes and social security contributions. It indicates how much citizens and residents are collectively paying to support public goods and services, such as healthcare, pensions, and infrastructure.

- **Generational Differences**: Different generations may contribute unequally to this burden due to economic factors, aging populations, and changing tax policies. Older generations (who rely more on pensions and healthcare) often require more government resources, while younger generations are typically contributing more through taxes and are burdened by the cost of supporting an aging population.

- **Widening Gap**: As populations age in many countries, especially in places like Japan, the national burden on younger generations increases, while older generations benefit from the social systems they paid into. This creates a growing **intergenerational imbalance** where younger people feel they are shouldering more of the economic burden without receiving the same future benefits.

### **Income Gap**

- **Income Gap** refers to the disparity in earnings between different segments of the population, often categorized by wealth class (rich vs. poor), gender, race, or geographic location. Income inequality can be measured through tools like the Gini coefficient, which reveals how unevenly income is distributed in a given country.

- **Wider than Ever**: Income inequality has been increasing in many parts of the world, with the top earners gaining a larger share of national income, while the wages of lower and middle-income workers stagnate. This gap has widened especially in recent decades due to factors like globalization, technological changes, and tax policies that benefit the wealthy.

- **Economic Disparity**: Unlike the generational burden ratio, the income gap is not just about intergenerational differences but affects people of all ages and is tied to economic opportunities, social mobility, and overall inequality in society.

### **Which is Wider?**

- **Income Gap** is typically **wider** because it affects the distribution of earnings across all demographics and is a persistent feature of economic inequality across generations, genders, races, and other groups. It is a structural and pervasive problem in most economies.

- **Generational Burden Ratio Gap** is significant in societies with aging populations, where younger generations bear a greater share of the financial load. However, its impact is often seen as part of a broader economic system and policy issue, rather than a structural inequality that cuts across all demographics like the income gap does.

### **Conclusion:**

While both gaps are concerning, the **income gap** is **wider** in the sense that it is a more pervasive, cross-generational inequality that directly affects economic mobility, opportunities, and quality of life across society. The **generational burden ratio gap** is important but more limited to the dynamics between age groups and public policy concerns related to social support systems.

所得格差のほうが広範で世代をまたがる問題で、経済的な流動性、機会、生活の質に直接影響を与えるわけだね。

世代間公平や不平等を言う人達はなんで社会の貧富の差についていわないわけ?

困窮した若者を救うために富裕層からもっと取れ!とならないで、貧困率の高いおばあちゃんや生活保護受給者から搾り取れになってしまうのか?

自民党だな。川口市クルド問題のA級戦犯の1人はこの議員。地元民が落とさなければ、クルド犯罪を容認した結果になる。 https://t.co/cyH2aHH8nM

— buvery (@buvery2) October 16, 2024

0 件のコメント:

コメントを投稿